binance us taxes reddit

Binance US taxes best practices are to create an account with cointracketio and connect via the tax api on BinanceUS. Scroll down and tap Tax Statements.

3 Steps To Calculate Binance Taxes 2022 Updated

The MIM stablecoin maintains its USD peg via arbitrage incentives.

. BinanceUS makes it easy to review your transaction history. They create gains and loss reports for you. This is the first time the Indian government is discussing crypto taxation.

We will continue evaluating coins tokens and trading. The ownership of any investment decisions exclusively vests with you after analyzing all possible risk factors and by exercising your own independent discretion. The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040.

Thats like 3 different symbol for one trade. The Tax Reporting Tool allows users to. According to their website.

Answer 1 of 12. Top these all up with a. Our mission is to provide liquidity transparency and.

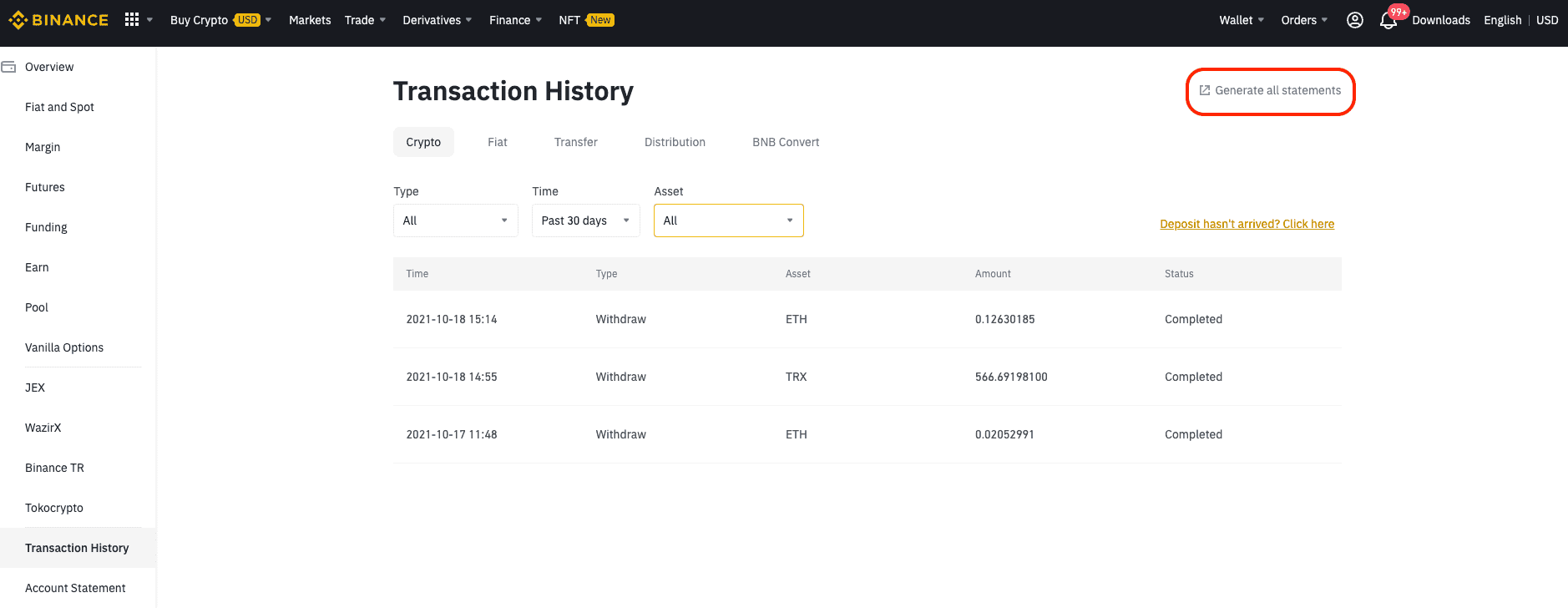

Transfer read-only user transaction history and records of capital gains and losses on Binance to third-party tax vendor tools. Binance a Malta-based company is one of the most popular crypto exchanges in the world. I am wondering if there is a limit to the number of tradestransactions that turbotax can accept and upload.

Really hoping someone has a definitive answer. BinanceUS reserves the right in its sole. Capital losses may entitle you to a reduction in your tax bill.

If you use Bitcoin to pay for any type of good or service this will be counted as a taxable event and will incur a liability. The ownership of any investment decisions exclusively vests with. Indian government just announced that crypto will be taxed at 30 of gains.

Use code BFCM25 for 25 off on your purchase. According to their website they stopped issuing 1099-K s from 2021 so they dont report to the IRS. Especially when you are dealing in so many decimals of whole units and the fees are in a totally different currency from the actual trading pair.

Currently Cointracker doesnt support margin or futures reporting but it is in development. Previously BinanceUS took the position that it was a Third Party Settlement Organization TPSO under Section 6050W of the Internal Revenue Code and accordingly filed Forms 1099-K for certain transactions settled on the exchange. You need to have a maintaining balance of 3k or else risk getting charged 300 and it requires 5k daily balance to start earning interest of less than 1.

OCEAN is an ERC-20 payment token and functions as the Ocean Protocols native token and is used for community governance as well as for staking on data. Any assets that stay staked for 100 days or more will receive impermanent loss protection. It is used to purchase datatokens which are critical to the functionality of the Ocean Protocol marketplace.

Users can access the Tax Reporting Tool via Account API Management on both Binance Website and Binance App. Business expenses will also not be allowed. The tax will apply to all gains on digital virtual assets and no capital losses will be allowed.

For certain transactions in the United States a 1099-K must be submitted with the Internal Revenue Service. By purchasing a particular data token on the Ocean marketplace users gain. How are regular people making returns of as much as 27144 in a year.

Launched in 2019 BinanceUS is the fastest growing and most integrated digital asset marketplace in the United States powered by matching engine and wallet technologies license from the worlds largest cryptocurrency exchange - Binance. How to generate your Tax API Key on iOS or Android. Over the last few months changes have been released that go beyond the original initiative to raise the cost of power from 00023 per Kwh to 001 for crypto miners which Kazakhstans First Vice Minister of Finance proposed to Marat Sultangaziyev in February.

And oh be ready to get charged 30 if your account is dormant for 6 months. BinanceUS is a fast and efficient marketplace providing access and trading for 85 digital assets. You can generate your gains losses and income tax reports from your Binance US investing activity by connecting your account with CoinLedger.

Binance tax documents to know everything about Binance taxes and Binance tax reporting thatll help you stay on top of your taxes. Alternatively Bancor offers impermanent loss protection at 1 per day on an opt-in basis once users have staked. Automatically sync your Binance US account with CoinLedger by entering your public wallet address.

BinanceUS does not currently support ERC20 and BEP20 TRX deposits and withdrawals. Abracadabramoney is a decentralized finance DeFi lending protocol that allows users to borrow magic internet money MIM a USD-pegged stablecoin that can be exchanged for other stablecoins in exchange for lending interest-bearing tokens as collateral. BNT is an ERC20 token that serves as the native asset of Bancor.

Still that would be a lot more transactions. According to the chamber the changes were intended to offer a jolt of fresh air. Do not send ERC20 and BEP20 TRX tokens to your BinanceUS wallet.

This goes for ALL gains and lossesregardless if they are material or not. I have this same question. Buying goods and services with crypto.

No they stopped issuing 1099-K s from 2021 so they dont report to the IRS. Under Tax Statement Methods tap Tax API. Users earn BNT in exchange for providing liquidity or staking on Bancor.

I have tried deleting and creating new API keys several times and none of them go. Open the BinanceUS app and tap the User Profile icon on the bottom navigation bar. Valid from 1126 to 1130.

NO Binance does not report to the IRS. Tax Regulatory Reporting Data Analyst. Get a real-time overview of their local tax liabilities by integrating third-party tax.

However Binanceus read more about the differences between Binance and Binanceus here does report to IRS just like many other popular exchanges do as well. BinanceUS does NOT provide investment legal or tax advice in any manner or form. I also for the past few weeks have been unable to get turbotax to accept my tax API key from BinanceUS.

Binance US Tax Reporting. What I dont understand is why binance global prohibits US-based users I assume this is so binance can comply with US regulations yet certain crypto tax reporting tools require the user to specify if they have traded on binance global in order to generate an accurate tax report. There is no other way.

BinanceUS does NOT provide investment legal or tax advice in any manner or form. There are a couple different ways to connect your account and import your data.

How To Obtain Tax Reporting On Binance Australia Frequently Asked Questions Binance Support

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency

Crypto Taxes In 2021 Tax Guide W Real Scenarios R Cryptocurrency

3 Steps To Calculate Binance Taxes 2022 Updated

3 Steps To Calculate Binance Taxes 2022 Updated

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

How To Prepare Your Crypto Taxes Bittrex Exchange

How To Obtain Tax Reporting On Binance Australia Frequently Asked Questions Binance Support

Serious How Are You Dealing With Crypto Tax In 2020 2021 R Cryptocurrency

New Upgraded Tax Reporting Tool R Binanceus

How To Obtain Tax Reporting On Binance Australia Frequently Asked Questions Binance Support

How To File Your U S Crypto Taxes R Cryptocurrency

How To Obtain Tax Reporting On Binance Australia Frequently Asked Questions Binance Support

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

The Complete Pancakeswap Taxes Guide Koinly

What You Need To Know About The Binance Tax Reporting Tool Binance Blog